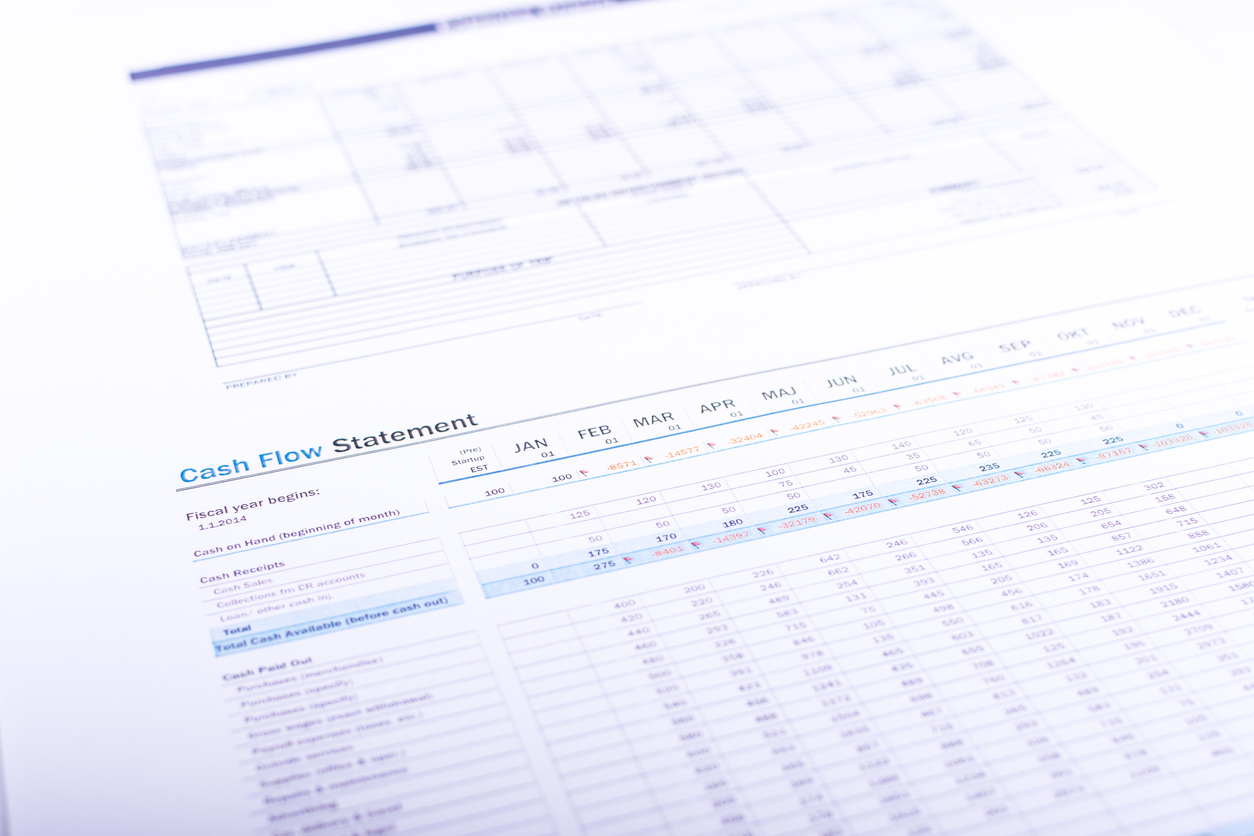

The Cash Flow Statement (CFS), also known as a Statement of Cash Flows, is one of the main reports in your financial statements documenting the total amount of cash and cash equivalents your business received and used during a specified period. It highlights changes in assets, equity, and liability, charting the total change in use of cash during the period. This reveals a business’ liquidity and helps analyze and assist in predicting future cash flows or cash flow projections by planning for the cash liquidity you expect in the future; a vital tool in determining long-term business plans.

To break it down further, the statement is an annual report detailing how money has moved in and out of a business. It shows how much cash your business has, where it came from, and where it went. The CFS serves as a bridge between the balance sheet and income statement, clearly illustrating which accounts have seen an increase or decrease in liquidity over the course of a year of company’s operating activities.

Positive Cash Flow

Cash flow is how much money you bring in versus how much you spend. If you have positive cash flow, this means the amount of cash coming into your business is greater than the amount of cash flowing out of it. It’s important to note that just because you are receiving more money than you are

Negative Cash Flow

Basically it means a business scenario when the company is spending more cash than it’s generating. This is fully explainable for companies in their growth phase as they need to spend money to drive growth, for customer acquisition or to set up their product or service distribution channels. In plain terms, it’s a numbers game where the incoming cash is less than the outgoing money. In this negative position, the shortfall should be supported by equity infusion, debt funding, or both.

We’ll have more information on the calculation process and specifics on what cash flow statements contain in future articles. Meanwhile, getting paid efficiently and faster while reducing high credit card transaction fees is a great way of ensuring positive cashflow. Contact an eTreem expert to learn how our B2B Payment Processing Platform can help to make this happen for your company