Fintech is a term used to describe the intersection of finance and technology. It refers to companies that use technology to provide financial services and products in innovative and more efficient ways. It is also described any business that uses technology to modify, enhance, or automate financial services for businesses or consumers. The goal of fintech is to improve the delivery and use of financial services, making them more accessible, affordable, and convenient for individuals and businesses.

Fintech companies use a variety of technologies, to offer a wide range of financial services technology using mobile applications, blockchain, artificial intelligence, and machine learning, to provide a range of financial services such as payments, lending, personal finance management, insurance, and wealth management.

Fintech History

Fintech has its roots in the late 20th century, with the advent of electronic banking and online stock trading. According to the IEEE Computer Society, the first prominent manifestation of fintech was the introduction of ATM in the late 1960s, followed by the advent of full-scale online banking in the early 1980s. By the turn of the millennium, eight banks in the United States had more than a million online customers combined.

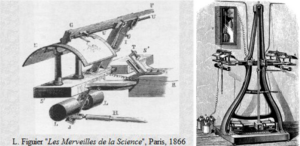

The history of fintech dates back even further, with the invention of the telegraph in 1838 and the laying of the first successful transatlantic cable in 1866, which enabled faster and more efficient communication of financial information, The origins of fintech may also be traced back to the 1800s with the development of pantelegraphy by Giovanni Caselli, which was mostly used to verify signatures in banking transactions by sending and receiving transmissions on telegraph cables.

The positive disruption of Bitcoin, Ethereum, and mobile payment services has brought a change in B2B buyer behavior, now shifted toward an omnichannel B2C-like experience – closely emulating their everyday exchange in making and receiving payments. These technology changes also present the opportunity to create new global payment networks that are much more secure, quick, transparent, and easy to use – ultimately providing better service for everyone. These innovations have already begun to lay the new foundation for money and banking.

By working with an intelligent B2B platform like eTreem, you can see how automating invoice payments helps you receive cash faster, minimize manual collections and bring savings to your bottom line. Contact us to find out how.