B2B Payments Portal

B2B payment portals are online platforms that enable businesses to manage their payments and transactions with other businesses digitally. Depending on the specific platform and breadth of features offered, portals provide a secure and efficient way for businesses to send and/or receive payments, track invoices, and manage their accounts payable or accounts receivable.

Typically, B2B payment portals work by allowing businesses to create an account and link their bank account or credit card to the portal. Some portals will offer eCheck (electronic check) functionality, a safer and more protective EFT (electronic funds transfer) method. The “EFT” classification gives eChecks even higher security protection, as transactions are covered by Regulation E of the Electronic Funds Protection Act, put in place by the Federal Reserve Board. The legislation gives users up to 60 days to resolve a transaction issue in the following categories:

- Unauthorized electronic funds transfers (EFTs)

- Incorrect EFTs to or from payor’s account

- Omission of an EFT from their bank statement

- Computational or bookkeeping errors made by the payor’s bank regarding an EFT

- Receipt of an incorrect amount of money from an automated teller machine (ATM) or an electronic payment terminal

- Errors involving pre-authorized transfers

- Requests for additional information or clarification concerning an EFT (citation)

Additional Capabilities

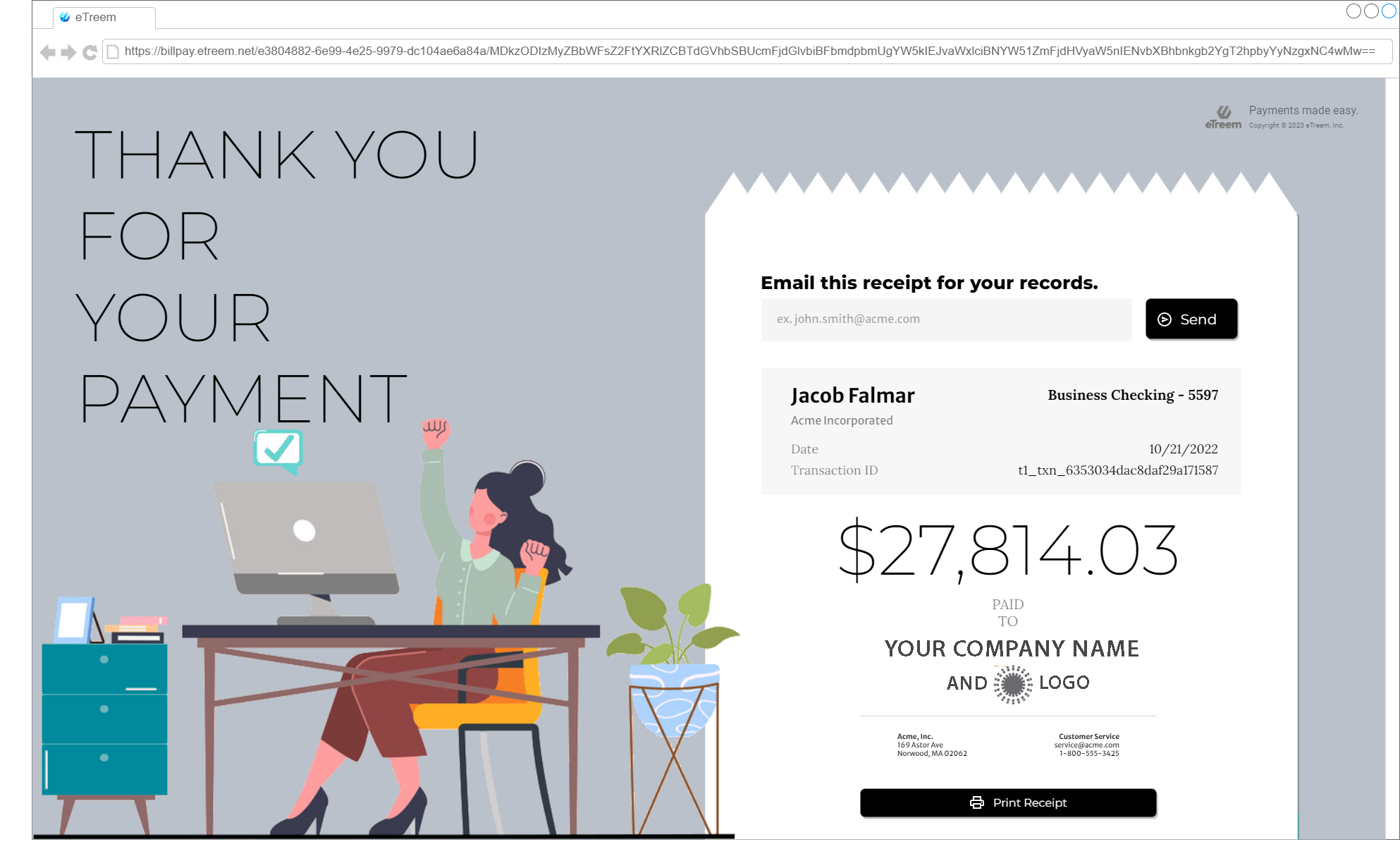

Some platforms give a user the ability to pay without establishing an account or logging in to an existing one. At the B2B level, most companies prefer to utilize an account-based model which we will illustrate in this article.

Once the portal account set-up is completed, businesses can use the portal to send or receive payments electronically, track invoices, and manage their accounts receivable or payables or both. Some B2B payment portals also offer additional features, such as automated payment reminders, dunning notifications, dispute resolution services and invoice financing (factoring). Used mostly in smaller businesses, factoring is a short-term loan that allows businesses to shift payment collection responsibility to an invoice factoring company for a fee.

B2B On-line Payment Portal Benefits

Faster Payment Processing Times

Online Portal payments are processed quickly & efficiently, reducing the time to receive payment for goods or services.

Enhanced Security

B2B online payment portals typically offer secure payment processing, which enable businesses to reduce the risk of fraud and other security threats.

Improve Working Cashflow

By receiving payments more quickly, businesses can improve their cash flow and better manage their working capital.

Improved Accuracy

Online payments can help reduce the risk of inaccuracies associated with manual payment processing, such as data entry mistakes or misplaced invoices.

Reduced Administrative Costs

Online payments can help businesses reduce the cost and time associated with manual payment processing and invoicing.

Increased Convenience

B2B online payments offer customers a convenient way to manage payments and transactions, without the need for manual processing or in-person interactions.

By using a B2B payment portal, businesses can streamline their payment processes, reduce the risk of errors, and improve their overall financial management.

eTreem enables accounts receivable departments to minimize manual process inefficiencies and maximize savings with our Intelligent B2B Payment Platform and Self-Service Portal. Contact us to find out how