In this blog, we delve into the intricacies of Level 3 credit card data, explaining its role in securing cost savings, providing detailed transaction insights, and enabling smarter financial management. Learn how businesses, especially those in B2B industries, can harness the power of Level 3 processing to not only track spending meticulously but also enjoy up to a staggering 1.00% reduction in interchange rates.

But before you understand L3 data, you need to understand Level 2 credit card data.

What is Level 2 Credit Card Processing?

Level 2 vs level 3 are both used in B2B and B2G transactions to help secure lower interchange rates and monitor spending. It involves the input of additional data through extra line-item details outlining the nature of each transaction for both the business and credit card companies.

This additional data is reported back to Visa and Mastercard, allowing businesses to keep track of, receive applicable sales tax detail, and set restrictions on purchases made with a company credit card. This allows any business to better stay on top of their spending, ensuring that their funds are best utilized to further their operations.

But what’s the difference between Level 2 and Level 3?

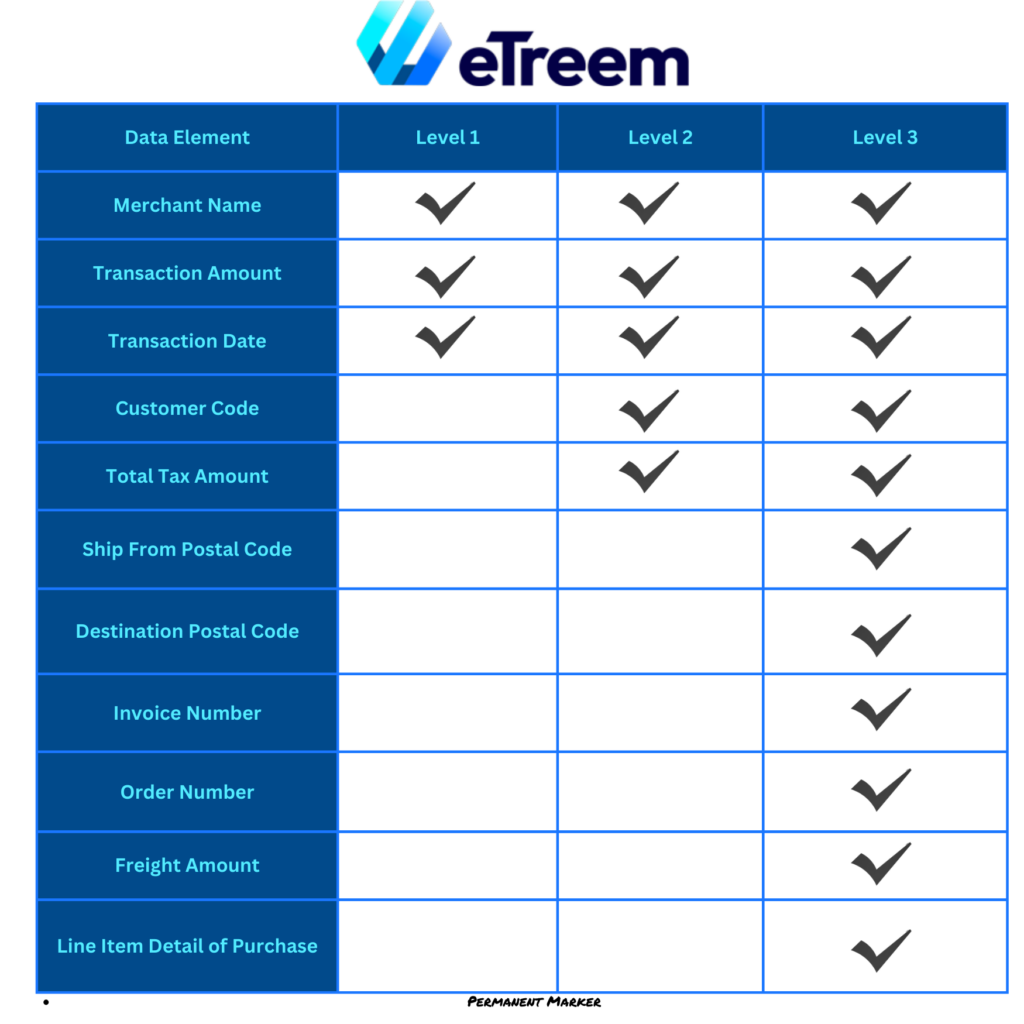

Level 2 processing is similar to Level 3 processing, but with less credit card processing requirements. Compared to Level 1 processing, merchants are required to input additional data fields – but compared to Level 3, the required fields are easier to enter and there are fewer fields to deal with. Level 2 processing provides a rate reduction, but not quite as much as level 3 processing. To better understand each level, view the table below to compare the various required data points.

Compare the various data points required for each credit card level.

If you’re a B2B merchant processing large orders, it’s definitely worth your while to input Level 2 credit card processing data. In order to qualify for Level 2 data, you’ll be required to input the following data fields with each transaction:

- Tax Amount (Between 0.1% and 31% of the total amount)

- Transaction Date

- Customer Code or PO number

- Merchant Zip Code

Its important to note that the type data required may vary by provider. To unlock even more savings and take advantage of greater B2b interchange rates, you’ll want to utilize credit card level 3 data.

What is Level 3 Credit Card Processing?

Level 3 processing is even more secure because businesses must furnish 11-13 points of data, significantly more than the requirements for Level 1 or Level 2 transactions. By providing this extensive information, businesses signal to credit card data providers that their transactions are less risky and less prone to fraud. Consequently, this results in a reduced base cost per customer transaction, translating to substantial savings for businesses accepting B2B credit card payments.

To learn even more about Level 3 processing rates, check out our blog What is Level 3 Credit Card Processing? Next, let’s outline the specific credit card transaction data required to achieve Level 3 benefits.

Level 3 Data

If you’re processing in a B2B industry or if you accept a lot of Government cards, then having Level 3 data acceptance can help reduce your interchange costs significantly. Often times, Level 3 interchange rates are up to a full 1.00% lower than their standard counterparts. But, in order to gain access to Level 3 data, you’ll be required to input a fair amount of information on each transaction. Additionally, only certain gateways can accommodate Level 3 data. Level 3 support will automatically populate all fields required for Level 2 (see below), plus the following:

- Ship-From Zip Code

- Destination Zip Code

- Invoice Number

- Order Number

- Item Product Code

- Item Commodity Code

- Item Description

- Item Quantity

- Item Unit of Measure

- Item Extended Amount

- Freight Amount

- Duty Amount

While the idea of providing extensive line-item detail may seem daunting, there are card payment solutions that automate this process. Here at eTreem, we can help your business seamlessly incorporate Level 3 data into your transactions, taking advantage of the associated cost savings. By leveraging Level 3 credit card processing through our intelligent platform, your company can strategically minimize their credit card processing costs. Contact us to find out how to get started.

Ready to leverage the savings of Level 3 data credit card transactions?

There are card payment solutions that automate the process of collecting and sending level 2 and Level 3 card transaction data – meaning you can start taking advantage of substantial savings as you accept and process B2B credit card payments. By working with an intelligent B2B platform like eTreem your organization can minimize the cost of processing credit cards and realize savings in your bottom line. Contact us to find out how.