Hunting down customer payments isn’t the most practical approach to debt collection. Collection pursuit takes a lot of time, resources, and headaches for both parties. Moreover, these efforts may negatively impact a company’s relationship with its clients. No one relishes being called out and pushed to complete a payment, especially so when doing the proper thing was always in their plans. Luckily, current technologies have given businesses across the globe more efficient ways to pursue past-due payments. Reminders for payment automation is a technology that helps businesses keep their financial process efficient.

In this blog, we cover the advantages of setting up automated payment solutions, including auto-reminders and auto-pay options. In addition, we highlight our automated payment solutions here at eTreem.

The Basics of Payment Automation Notifications

Payment reminder notifications are a type of communication sent to customers to remind them of upcoming or overdue payments. These notifications, whether through email, text messages, or mobile app push notifications, serve as a vital communication channel to ensure timely payments. In the B2B space, payment notifications are most often sent via business email.

Automating payment notifications can be effective in increasing payment rates, reducing right-off losses, and improving customer satisfaction. Additionally, automating the dunning process can save time and manual human effort and help improve the efficiency and effectiveness of the accounts receivable process.

Automated payment reminders offer several benefits for users, including:

- Improved payment rates: Automated payment reminders can help users improve their payment rates by reminding customers of upcoming or overdue payments, which can help prevent past-due payments.

- Reduced workload: Automated payment reminders can help prevent past-due payments making the repayment process smoother and reducing AR staffs’ workload to focus on more productive activities.

- Improved cash flow: Automated payment reminders can help users improve their cash flow by allowing them to send invoices quickly and schedule billing reminders, which can help shorten the invoice-to-cash cycle.

- Improved customer satisfaction: Automated payment reminders can help improve customer satisfaction by providing timely and relevant information about their payment status and reducing the risk of late fees or penalties.

Overall, automating invoice reminders can be an effective way to streamline the collections process and improve payment rates, DSO (Days Sales Outstanding) and give a good boost to cash flow.

What is Payment Automation?

Not only can you automate reminders for payments, but you can automate the payments themselves. An automated payment system streamlines and controls the process of making and receiving payments. This can be applied to various financial transactions within an organization, between businesses, or between businesses and consumers. For example, payment for monthly subscriptions may be automatically taken out of a customer’s account on the same day each month.

Payment automation aims to reduce manual intervention, enhance efficiency, and improve accuracy in financial processes. Typically, automated payments are used for recurring payments such as bills or subscriptions.

When you automate payments, your customers don’t have to worry about due dates or late fees. Plus, you ensure that your cash flow is consistent each billing cycle. This results in a more efficient, accurate, and secure financial process.

Reminders For Payment Automation Should Go Hand In Hand

When you set up both reminders and auto-pay, you can achieve maximum customer satisfaction. Without the auto-reminders, your customers may become displeased when they are charged unexpectedly. The integration of both automated payment reminders and a robust automated bill payment system is a strategic move for businesses aiming to optimize their financial processes. It not only ensures timely payments but also contributes to operational efficiency, customer satisfaction, and overall financial well-being.

To unlock the full potential of payment automation, businesses can explore the offerings of eTreem and take a step towards a more streamlined and efficient financial future.

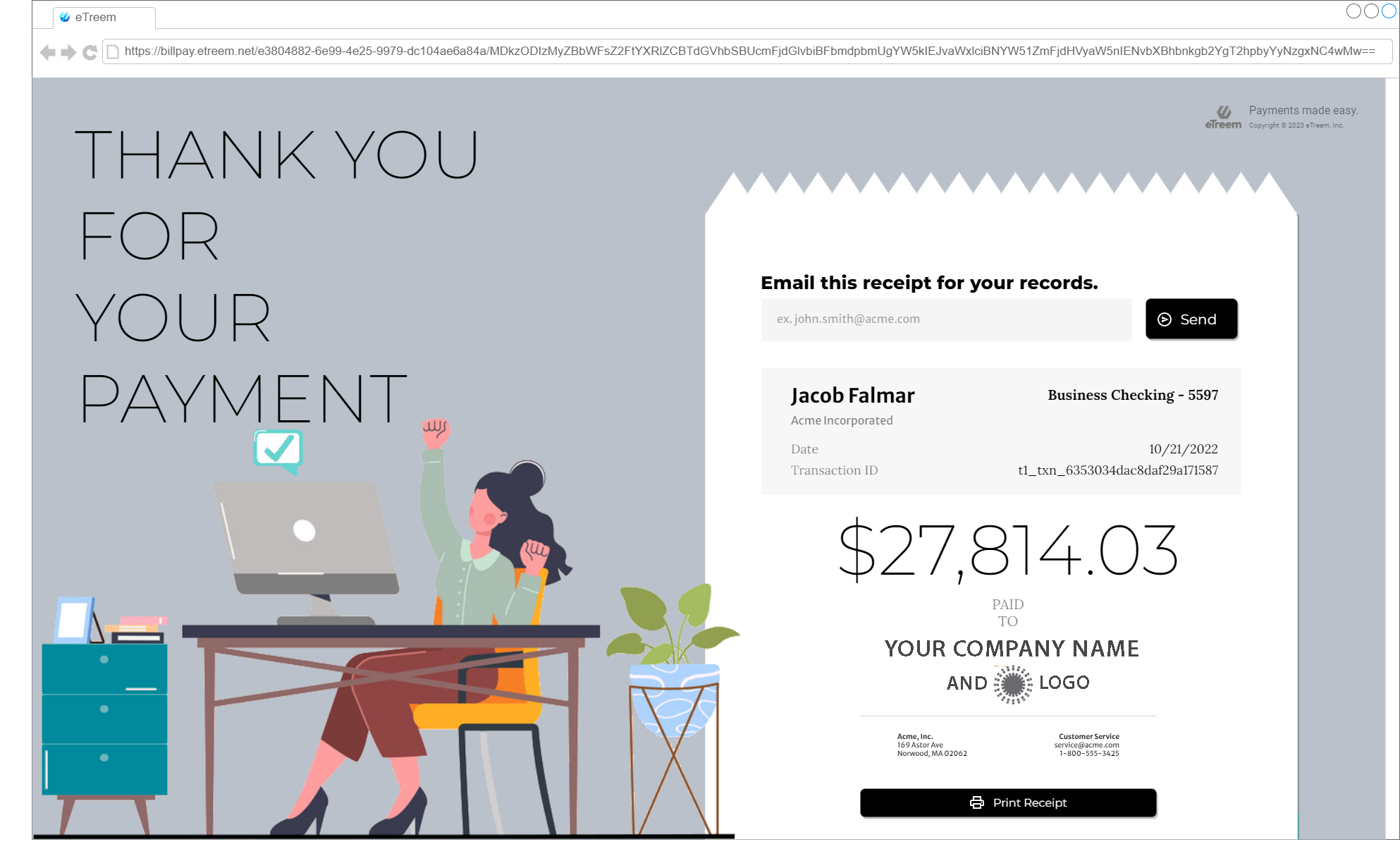

eTreem’s Payment Automation Software

With eTreem’s automated payment processing, your business can seriously improve their collections processing and maintain positive relationships with their customers. Our automated payment services include both auto-pay and reminders. Contact an eTreem expert to learn how our Intelligent Payments Platform solution can optimize your company’s receivables payments and collections processing. Reach out to us today.